THE FUTURE OF INVESTMENT

WHY PDS?

PDS is the next step in our Appraisal software journey. With a sophisticated format to enter information, be it for residential, commercial or mixed-use development projects.

With up to 20 individual projects able to be consolidated into a cashflow report.

Button

WHAT CAN IT DO?

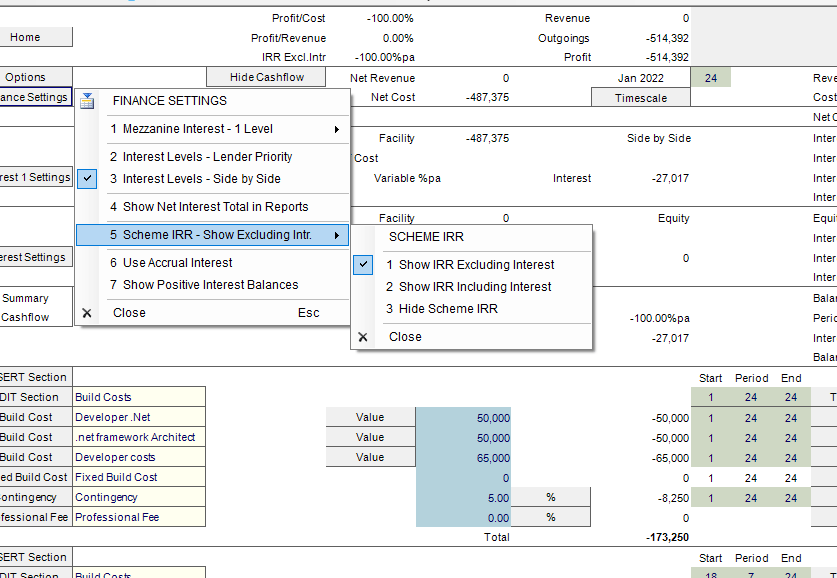

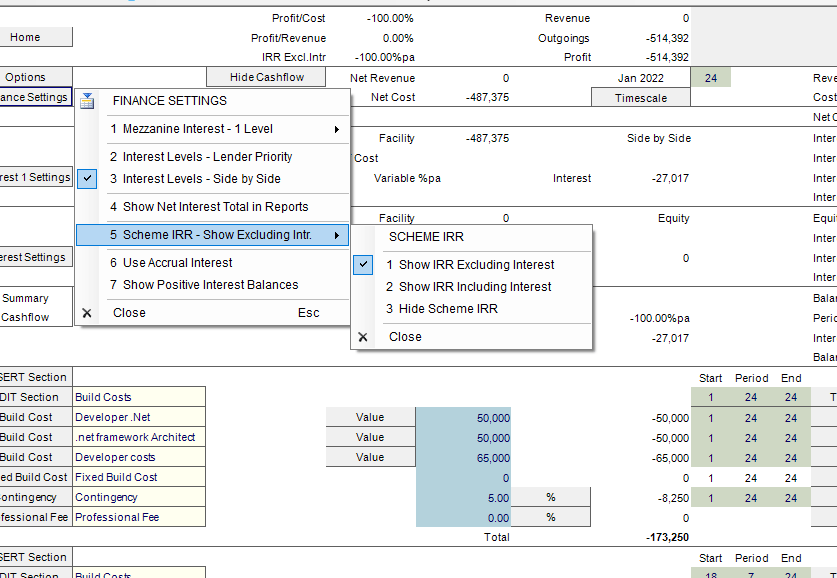

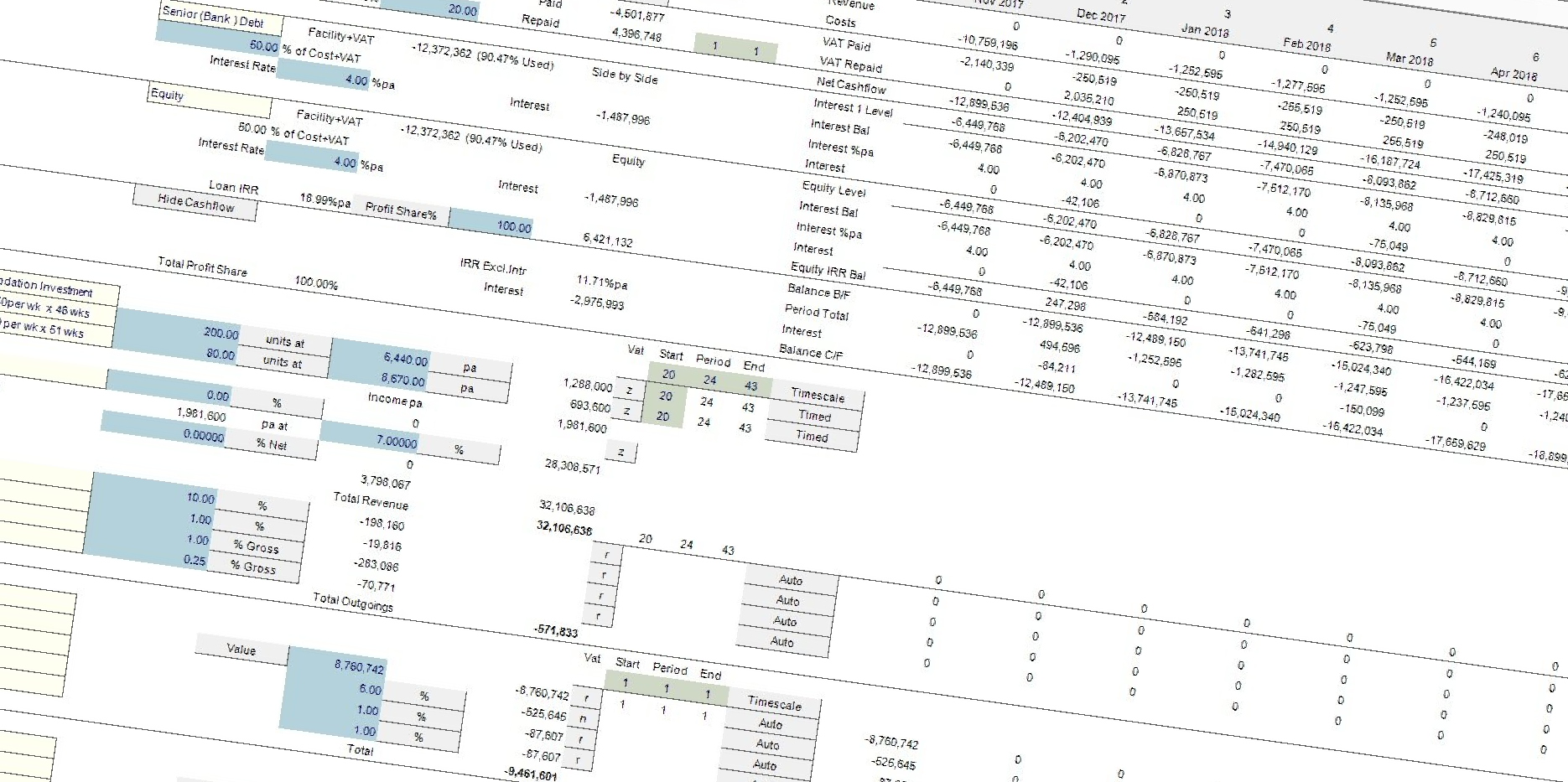

Unlimited data entry, no limit as to the number of elements eg. rents, yields, building costs etc. Also there is no limit to the number of individual sections. A completely revised finance section that allows up to 5 separate debt levels. Each loan level allows for bank entry, exit and arrangement fees. IRR performance for each loan can be displayed along with an allowance for profit share. Inflation and Rental Growth.

Button

TELL ME MORE...

PDS enables the setting of inflation in all sections. The rental category allows for both inflation from start and rent review patterns to be set. Rental income received prior to the eventual investment sale is calculated.

Ability to reforecast revenues and cost, to enable comparison of initial and actual feasibilities, maintaining control over risk and reward.

Button

PDS simplicity...

The PDS interface is really easy to understand and even easier to use. Simply open the main screen and input data on to the cashflow. Simply press on the type of apprasial you require (Investment, Direct Sale or Mixed Use scheme). Then you can enter as much detail as you need. From Finance levels settings, Interest Settings to the preferred IRR. See the video below to understand how easy it is.

PDS is the key to success.

It has the ability to reforecast revenues and costs, to enable comparison of initial and actual feasibilities, maintaining control over risk and reward.

See our easy to understand video below

New Paragraph